Data Bytes: Enterprise Cloud Spending Gets $1.5B Boost From Pandemic

Data Bytes is a weekly roundup of research and analysis for the data center and cloud computing sector. Want to get it in your Inbox every Monday? Sign up for our DCF news updates.

This week we have several views of trends in capital spending on data center infrastructure, and how it has been impacted by the COVID-19 pandemic. Data from Omdia projects robust future growth for cloud and colocation spending in coming years, while Synergy Research seeks to quantify how the shift to online services during the pandemic showed up in cloud spending data.

Synergy: Pandemic Boosted Cloud Spending by $1.5 Billion

New data from Synergy Research Group shows that “enterprise spending on cloud services got a big boost in the third quarter, as COVID-19 drove changes in enterprise behavior and sped up the transition from on-premise operations to cloud-based services.”

The timing on this is interesting, as data center leasing saw a huge jump in the second quarter, but that appears to have been driven primarily by cloud platforms, social networks and video networks. Meanwhile, public service providers reported that enterprises appeared to pause their spending as they assessed the depth of the pandemic. It will be interesting to see if Synergy’s data portends a return to spending by enterprise players, who have little choice but to invest in digital services to adapt to pandemic-driven changes in business and society.

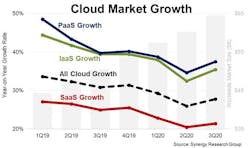

Synergy reports that enterprise spending on cloud infrastructure services (IaaS, PaaS and hosted private cloud services) and SaaS reached $65 billion in the third quarter, up 28% from the third quarter of 2019. PaaS continues to have the highest growth rate, reaching 37% in Q3, but growth is strong across a broad range of cloud segments and all geographic regions.

Synergy notes that IaaS, PaaS and SaaS are all now massive markets that are still growing rapidly, but their scale has inevitably caused growth rates to erode steadily. However, in Q3 all three of these cloud services saw their growth rates bounce back noticeably, adding some three percentage points of growth to what would have been expected under normal circumstances. Every quarter the major cloud providers are benefitting from substantially increased enterprise spending on their services. Synergy estimates that spending in the third quarter increase got an added boost of around $1.5 billion.

“At Synergy we track cloud market numbers very closely and we knew there would be strong growth in Q3, but the actual growth was higher than we’d expected,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “There is no doubt that COVID-19 was the main reason for that boost.

“Workloads are being shifted to public clouds even more quickly than anticipated and hosted software apps are especially attractive for enterprises navigating their way through a worldwide pandemic,” Dinsale added. “Rapid adoption is also being helped by a plethora of hybrid cloud services which are helping to smooth the path towards greater usage of public clouds. Whatever a post-pandemic world may look like, we don’t expect those trends to reverse.”

Omdia: Secular Growth Trends Boost Cloud, Colo

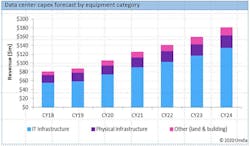

Omdia, the consolidated research arm of Informa, affirms the expectations of continued growth. Omdia’s Cloud & Colocation Data Center Capex Market Tracker projects that data center capex by cloud and colocation service providers is expected reach $180 billion in 2024, growing at a 15.7 percent compound annual growth rate (CAGR) from 2020 through 2024 as service providers work to stay ahead of customer demand.

Projections of data center capital spending growth and sector distribution, via Omdia.

Cloud and colocation service providers continue to benefit from the sustained secular demand trends already in place, but enterprises will continue to accelerate their digital transformation activities as they mitigate the risk of potential unknown future fallout from the pandemic and its economic impact.

The greatest portion of total data center capital spending is IT equipment including servers, storage, networking and other devices, which is forecast to be 71.5% of total spend for CY20. Physical infrastructure equipment represents 19.5% and land & building at 9%.

“Cloud and colocation service providers have been benefactors of increased SaaS and network customer demand from the pandemic response necessitating remote working and educating,” said Alan Howard, principal analyst at Omdia. “Whilst there has been some challenges and delays in data center projects driven by the pandemic, we are not seeing or anticipating a pull-back on investing in the very heartbeat of services delivery, which is the data centers themselves.”

About the Author