Data Bytes: Cloud CapEx, PUE Trends, HPC Spending, Servers on the Edge

Data Bytes is a weekly roundup of research and analysis for the data center and cloud computing sector. Want to get it in your Inbox every Monday? Sign up for our DCF news updates.

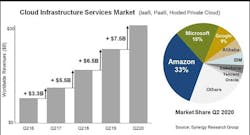

Spending on cloud infrastructure passed the $30 billion milestone in the second quarter of 2020, an increase of $7.5 billion from the same period in 2019, according to Synergy Research Group. This continues the trend of steady, massive increases in cloud spending by hyperscale operators.

“As far as cloud market numbers go, it’s almost as if there were no COVID-19 pandemic raging around the world,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “As enterprises struggle to adapt to new norms, the advantages of public cloud are amplified. The percentage growth rate is coming down, as it must when a market reaches enormous scale, but the incremental growth in absolute dollar terms remains truly impressive. The market remains on track to grow by well over 30% in 2020.”

Amazon market share remained at its long-standing mark of around 33%, while Microsoft was at 18% for the third consecutive quarter and Google share nudged up to 9%. In aggregate Chinese cloud providers now account for over 12% of the worldwide market, led by Alibaba, Tencent and Baidu. The top eight cloud providers now account for 77% of the worldwide market. They are followed by a long tail of small providers or large companies with a minor position in the cloud market.

Uptime: Outages Persist, PUE Gains Flatten

Uptime Institute released the key findings of its 10th annual Global Data Center Survey, with responses from nearly 850 data center managers. As you might expect from the group’s name and mission, outages were a key focus.

“In surveys from 2018 and 2019, and now supported by our 2020 survey, outages occur with disturbing frequency, bigger outages are becoming more damaging and expensive, and what has been gained in improved processes and engineering has been partially offset by the challenges of maintaining ever more complex systems,” Uptime noted in its summary. “Avoiding unplanned downtime remains a top technical and business challenge for all owners and operators.”

“Our 2020 survey results reflect a strong, growing sector facing increased change and complexity,” said Andy Lawrence, Executive Director of Research at Uptime Institute. “The growing complexity, along with the greater consequences of failure, creates the need for more vigilance and more sophisticated approaches to resiliency, performance and operations.”

One of the Uptime metrics is average Power Usage Effectiveness (PUE), a key energy efficiency metric which is closely watched by some in the data center industry. Uptime places the average PUE at about 1.6, little changed from results dating back to 2013. Since most data center REITs report PUEs in the 1.2 to 1.3 range, and hyperscalers often reach 1.1 to 1.2, the survey data reflects the state of many enterprise facilities. “Because more work is now done in big, efficient facilities, the overall energy efficiency of IT has improved,” Uptime noted.

For more, see the summary press release or full report. Other data points from the Uptime report:

- Public cloud usage is expected to increase from 8% of all IT workloads today to 12% within a two-year period. “This limited adoption appears to be a strong growth opportunity for public cloud providers,” said Uptime (see the Synergy data above).

- The mean density for rack density in 2020 was 8.4 kilowatts per rack. Additionally, densities are rising, but not enough to drive wholesale site-level changes in power distribution or cooling.

- Edge computing requirements are expected to increase slightly in 2020, but fewer than a fifth of all respondents expect a significant increase.

- Artificial intelligence and automation will not reduce data center operations staffing requirements in the next five years. After that, however, most think it will.

- The data center staffing crisis is getting worse. The number of managers stating they are having difficulty finding qualified candidates for open infrastructure positions is rising steadily. Women continue to be under-represented. More effort is needed to address the workforce gender imbalance and take advantage of the larger and more diverse skilled talent pool.

COVID-19 Prompts Pause in HPC Spending

HPC and hyperscale analyst firm Intersect360 Research pegs the size of the High Performance Computing (HPC) industry at $39 billion in 2019, a jump of 8.2% from 2018. The Intersect 360 forecast predicts “significant disruption” to the HPC market in the short term as a result of the COVID-19 pandemic, primarily seen as a 3.7% market shortfall in 2020, followed by a corresponding spike upward in 2021.

In spite of the 2020 dip, the HPC market will grow at a 7.1% compound annual growth rate through 2024, to reach $55.0 billion at the end of the forecast period.

“In forecasting the effects of the pandemic, we’re not operating in a vacuum,” says Intersect360 Research CEO Addison Snell. “We’ve seen recessions before, and we’ve seen supply chain disruptions, such as what happened with the horrible floods in Southeast Asia in 2011, and the resulting effect on the storage market.

“The market is about to take a very strange shape,” Snell added. “2020 will be down significantly, but most of this shortfall is from purchases that are delayed, not canceled. So long as the economy comes back in 2021, we’ll see a big spike as those delayed HPC purchases get realized.”

According to the series of four new reports from Intersect 360, government spending is back at the forefront of HPC growth after six years of the industrial sector driving HPC market.

“This will be the most stable sector over the next five years,” said Snell. “Many austerity measures have been relaxed, and government spending has come back up. There’s a big push to AI, of course, as well as mustering resources to combat COVID-19. Beyond that, the race to Exascale continues to add energy into supercomputing.”

Snell points out that the cloud segment is an area of significant opportunity. “Cloud computing is the segment that will do the opposite of everything else. When on-premise server and storage purchases are delayed, cloud computing can help bridge the gap. There will be a big spike in cloud computing for HPC this year, as other forms of acquisitions are constrained.”

Omdia: Edge Servers Will Double by 2025

The number of servers deployed at edge locations will double over the next 5 years, according to Omdia. A total of 4.7 million servers shipped in 2024 will be located at the edge. Omdia defines the edge as locations with a maximum 20 milliseconds (ms) round trip time (RTT) to the end user, device or machine. This includes telco IT-operated sites like central offices (COs) and regional data centers (DCs), cloud service provider points of presence with equipment deployed at colocation provider DCs and enterprises deploying servers at branch offices, retail stores, campus sites and colocation provider DCs.

Omdia finds that 32.2 percent of servers shipped to telcos in 2024 will be deployed at edge locations, up from 22.8 percent in 2019. A large portion of the servers telcos have deployed at the edge so far are used for content delivery networks (CDNs). Surveying telcos, Omdia found that many edge-located server deployments will be justified by cost savings achieved by virtualizing network functions, followed by revenue-bearing new services.

“By 2024, a smaller portion of telco edge located servers will be running CDNs or virtual network functions (VNFs) in favor of other workloads such as video content delivery, vehicular communication for autonomous vehicles, AR/VR and gaming,” said Vlad Galabov, principal analyst for data center IT, at Omdia.

Omdia expects 12.2 percent of servers shipped to hyperscale cloud service providers (CSPs) to be deployed at edge locations by 2024, up from 5 percent in 2019. Drivers for the growth of the hyperscale CSP edge include the popularization of video streaming, which requires effective content delivery networks, and the pursuit of new services such as cloud gaming, PC as a service, and cloud AR and VR, where the latency between the end user inputting commands and the cloud-located server becomes critical.

Omdia forecasts 37.6 percent of servers shipped to enterprises will be deployed at edge locations by 2024, up from 28.4 percent in 2019. As shown in the figure below, enterprises were early adopters of edge computing for latency sensitive workloads like healthcare and industrial applications; on-site data consolidation, data sharing, and analytics; and retail store management.

About the Author