Analyst: Enterprise CIOs Seek Simplicity, May Use Fewer Data Center Providers

ASHBURN, Va. – Enterprise decision makers are increasingly looking for single providers to meet their data center and cloud computing needs, according to new data from a Credit Suisse survey of chief information officers.

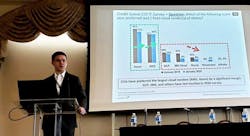

As a result, data center and cloud markets may be shifting to a “winner takes all” dynamic as more CIOs seek to simplify their global data center infrastructure, according to Sami Badri, senior analyst at Credit Suisse, who shared his research at the CAPRE Digital Infrastructure 2020 Forecast event last week.

Credit Suisse conducts regular surveys of enterprise chief information officers (CIOs) to gauge trends in the multi-tenant data center market. In 2019, about two-thirds of CIOs said they favor using multiple colocation and wholesale data center providers for their outsourced hybrid cloud deployments.

The multi-provider approach spreads risk, and also provides more options for companies that deploy IT infrastructure across many geographic markets.

That has changed significantly in recent months, according to Badri. In the January 2020 survey, 61 percent of CIOs said they prefer working with a single provider, compared to 36 percent favoring a multi-provider strategy.

“Many CIOs are now focusing on single colo providers rather than working with multiple providers,” said Badri. “This is a complete change, and an interesting shift in the industry. There’s growing favoritism about working with a go-to provider.

“This turns out to be a ‘winner takes all’ dynamic” for data center service providers, said Badri. “You will see some of the effects of that play out over the next six months.”

Data from a Credit Suisse survey of enterprise CIOs shows a shift in strategic thinking about the number of data center providers to host hybrid clouds. (Image: Sami Badri, Credit Suisse)

Interconnection and Global Scale Drive Shift

Two priorities are driving this shift – interconnection and scale. As companies become global and data-centric, network infrastructure is the key link in meeting business goals. The largest companies also covet a global footprint.

“You should expect to see a cross-connected international footprint become an even more strategically important variable,” said Badri. “It is almost like an arms race. You need to have the right footprint, the right international capabilities, and the right ecosystem. I believe enterprises CEOs will pay a premium for that. Pricing doesn’t become an issue when you get everything you want. That seems to be the winner-takes-all narrative that is starting to emerge.”

This dynamic is also being seen in the cloud computing sector, where Microsoft Azure and Amazon Web Services are the strong market leaders. An important development is the growth software-as-a-service (SaaS) platforms that can simplify operations for enterprise CIOs.

“If you are a software provider, you are going to borrow from the AWS, Megaport and Packet Fabric playbook,” said Badri, citing two providers of SDN-powered “on ramps” to cloud platforms. “You will to deploy into multi-tenant data centers. You want to make it easy for enterprises to deploy your service. This dynamic is proliferating. SaaS providers will serve as magnets that will concentrate enterprise business in dense interconnection locations.”

The Competitive Landscape

Customer preferences always have implications for the service provider community. The Credit Suisse CIO survey offers one take on enterprise preferences, but its findings won’t be a surprise to leading data center companies.

Interconnection and global scale are guiding the strategies of the two largest data center providers, Equinix and Digital Realty, which have each launched global expansions. Both companies have also taken steps to expand their offerings to span both retail colocation and wholesale data centers.

- Last year Equinix launched its xScale hyperscale offering to add large-footprint wholesale space adjacent to its interconnection hubs. Its recent acquisition of Packet adds edge computing capabilities, as well as the ability to offer cloud services directly to colocation customers.

- Digital Realty is buying Interxion to boost its European presence and interconnection as part of PlatformDIGITAL, a broad initiative to sharpen its focus on problem-solving for enterprise customers retooling their IT infrastructure.

The trend is also seen in the global expansion by Iron Mountain, which is in the process of beefing up its interconnection offerings and ecosystem. It’s also visible in the move by NTT Global Data Centers to consolidate its global network of data center companies, enabling customers to use a single global Master Services Agreement (MSA).

Meanwhile, large global investors are seeking to create platform companies that can compete at scale. Most of these new platforms are focusing on building their geographic footprint, but they also have the resources to acquire capabilities, such as interconnection.

“Expect cross connects and interconnection to become a major trend,” Badri predicted at the CAPRE event. “CIOs want to deploy to the path of least resistance. A lot of these mid-cap sized providers need larger reach and more interconnection density. Interconnection in colocation ecosystems will rule in 2020 to 2025,”

About the Author