Chip-to-Grid Gets Bought: Eaton, Vertiv, and Daikin Deals Imply a New Thermal Capital Cycle

Key Highlights

- Eaton’s acquisition of Boyd Thermal enhances its chip-to-grid thermal solutions, positioning it against industry leaders and supporting AI-focused data center growth.

- Vertiv’s purchase of PurgeRite emphasizes the importance of field capacity and service expertise in scaling liquid cooling for GPU-dense AI data centers.

- Daikin’s acquisition of Chilldyne signifies a strategic move into direct-to-chip liquid cooling, accelerating deployment in hyperscale environments.

- These deals reflect a broader industry trend where thermal infrastructure is now a balance-sheet priority, influencing enterprise valuations and capital allocation.

- The global liquid cooling market is projected to grow from $5.4 billion in 2024 to nearly $18 billion by 2030, driven by AI, GPU density, and efficiency gains.

This week delivered three telling acquisitions that mark a turning point for the global data center supply chain; and more specifically, for the high-density liquid cooling mega-play now unfolding across the power-thermal continuum.

Eaton is acquiring Boyd Thermal for $9.5 billion from Goldman Sachs Asset Management. Vertiv is buying PurgeRite for about $1 billion from Milton Street Capital. And Daikin Applied has moved to acquire Chilldyne, one of the most proven negative-pressure direct-to-chip pioneers.

On paper, they’re three distinct transactions. In reality, they’re chapters in the same story: the acceleration of strategic vertical integration around thermal infrastructure for AI-class compute.

The Equity Layer: Private Capital Builds, Strategics Buy

From an equity standpoint, these are classic handoff moments between private-equity construction and corporate consolidation.

Goldman Sachs built Boyd Thermal into a global platform spanning cold plates, CDUs, and high-density liquid loop design, now sold to Eaton at an enterprise multiple north of 5× 2026E revenue. Milton Street Capital took PurgeRite from a specialist contractor in fluid flushing and commissioning into a nationwide services platform. And Daikin, long synonymous with chillers and air-side thermal, is crossing the liquid Rubicon by buying its way into the D2C ecosystem.

Each deal crystallizes a simple fact: liquid cooling is no longer an adjunct; it’s core infrastructure. Private equity did its job scaling the parts. Strategic players are now paying up for the system.

Eaton’s Bid: The Chip-to-Grid Thesis

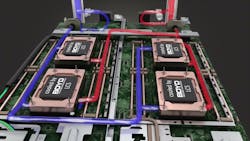

For Eaton, Boyd Thermal is the final missing piece in its “chip-to-grid” thesis. The company already owns the electrical side of the data center: UPS, busway, switchgear, and monitoring. Boyd plugs the thermal gap, allowing Eaton to market full rack-to-substation solutions for AI loads in the 50–100 kW+ range.

It’s a statement acquisition that places Eaton squarely against Schneider Electric, Vertiv and ABB in the race to become the integrated vendor of record for hyperscale AI factories. The deal also gives Eaton access to Boyd’s patent estate and its production capabilities for cold plates, manifolds, and dielectric coolant distribution.

From a capital-markets view, this is a growth-multiple acquisition: a way to attach the company’s stable electrical margins to a segment growing at 20-plus percent CAGR through 2030.

Vertiv’s Bet: Services Are the Moat

Vertiv’s $1 billion move for PurgeRite might look small next to Eaton’s headline number, but it’s arguably the most strategic of the three.

AI data centers are now bottlenecked not by design or supply, but by field capacity, i.e. the technicians and procedures that make liquid real at scale. PurgeRite brings Vertiv exactly that: trained crews, procedural IP, and national reach in flushing, purging, and commissioning for GPU-dense halls.

Vertiv’s earlier acquisition of Waylay NV for generative AI monitoring software now pairs neatly with PurgeRite’s service arm, giving the company both the digital and physical wings of liquid-infrastructure lifecycle management.

This is service margin as the new moat; a strategy straight out of private equity’s playbook, now internalized by one of the sector’s most agile strategic players.

Daikin’s Leap: From Air to Liquid

Daikin Applied’s acquisition of Chilldyne reads like an evolutionary inevitability. Negative-pressure D2C systems have moved from lab to large-scale deployment, especially in hyperscale GPU environments where cold-plate solutions outperform immersion on cost, maintenance, and rack density.

For Daikin, this deal shortcuts years of R&D and positions the company inside the very rack where thermal strategy is now won or lost. It also positions Daikin to compete with the likes of CoolIT (KKR), JetCool (Flex), and Asetek as liquid penetrates mainstream data center design.

The Macro Play: Thermal Becomes Strategic Infrastructure

Zooming out, these three acquisitions confirm that thermal has crossed the Rubicon into strategic infrastructure status.

What used to be a line-item category is now a balance-sheet priority. AI factories are discovering that cooling, like power, defines site feasibility, PUE, and cap-ex velocity. As a result, thermal platforms — not just products — are commanding enterprise valuations.

That dynamic is pulling traditional industrials and HVAC giants directly into the AI-era data center stack. Expect M&A to continue across CDU makers, manifold suppliers, fluid chemistry specialists, and control-software vendors, as buyers chase complete high-density ecosystems.

The High-Density Liquid Cooling Mega-Play

Here’s an industry snapshot as inferred from this story's press releases and tangential analysis:

- According to current analyst/market-research consensus from sources such as Grand View and Credence, the global data center liquid cooling market is expected to expand from ~$5.4 billion in 2024 to $17–18 billion by 2030, a 22–25% CAGR.

- High-density (>50 kW/rack) deployments will triple by 2028 as GPUs push thermal limits beyond what air can sustain.

- Considering vendor white papers and field-tested benchmarks (from Vertiv, NVIDIA, JetCool/Flex, etc.) used as contextual averages, it's possible to discern liquid cooling efficiency gains (i.e. 10–15% lower facility power draw, higher compute density) directly translating into TCO and carbon benefits, which are both monetizable in today’s ESG-constrained financing environment.

Ergo, AI modeling conducted by DCF suggests that a leading full-stack liquid-cooling provider with ~$300 million base revenue today could scale to ~$1 billion by 2030 with margin expansion from 12% → 15%, producing ~$70 million FCF and commanding enterprise valuations of $700 million–$1 billion — even before applying strategic-sale premiums.

That’s the mega-play: A multibillion-dollar category re-rating in real time, driven by the physics of compute and the flow of capital alike.

Prognostics: The Next Wave of M&A

Going forward, the industry might now look for consolidation in four hot zones:

- CDU and manifold specialists: To complete rack-level integration portfolios.

- Fluid-service networks: Regional players like PurgeRite that can scale to national SLA coverage.

- Control and telemetry software: Fusing pump, coolant, and GPU telemetry into autonomous orchestration (Vertiv’s Waylay hints at this).

- Alternative coolants and chemistries: Dielectric and two-phase systems that address safety, recyclability, and leak risk.

Behind the scenes of such plays, private capital will be looking for the next Boyd, and strategic vendors eager to own end-to-end solution stacks that hyperscalers will sign off on for 100 MW+ campuses.

The AI Inflection Point Sharpens

Three acquisitions. One message: AI is reshaping the industrial order of data-center infrastructure.

Private equity built the scaffolding. The data center industry's strategic infrastructure players are now buying the throughput. And in the process, they’re redrawing the competitive map from rack to substation.

As the sector transitions from evaporative air to engineered liquid, the winners may be those who can offer single-vendor accountability; and who understand that in the AI era, thermal is capital.

That’s the real story behind this week’s deals. The next chapter? It could be when the first “cooling super-platform” goes public, and investors finally start pricing liquid cooling not as a component, but as a megatrend.

At Data Center Frontier, we talk the industry talk and walk the industry walk. In that spirit, DCF Staff members may occasionally use AI tools to assist with content. Elements of this article were created with help from OpenAI's GPT5.

Keep pace with the fast-moving world of data centers and cloud computing by connecting with Data Center Frontier on LinkedIn, following us on X/Twitter and Facebook, as well as on BlueSky, and signing up for our weekly newsletters using the form below.

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.