CBRE Confirms Power Constraints Inhibit Record Data Center Demand

New research from CBRE highlights the rapid growth of the data center industry across the globe despite widespread limitations due to power supply constraints.

In its Global Data Center Trends 2023 report, CBRE finds the global data center market characterized by robust construction, increasing rents and demand driven by artificial intelligence and other technology advancements, including streaming and multi-cloud solutions, which are expected to increase the need for high-performing data centers.

The report analyzes key variables, such as total inventory, vacancy rates, net absorption, pricing and rental rates, and availability, in established and emerging markets across the key global regions of North America, Europe, Asia Pacific and Latin America. It is explicit on one point: Power supply has had difficulty keeping pace with data center industry growth across the globe, keeping vacancies low and pushing rents up even amid robust construction.

The report states that a worldwide shortage of available power is inhibiting growth of the global data center market, and that sourcing enough power is of top priority among data center operators across the key global regions. As a result, CBRE states that certain secondary markets with robust power supplies now stand to attract more data center operators.

For example, the report suggests that, despite strong near-term market fundamentals, power supply constraints could limit or delay development in markets such as Frankfurt, Tokyo and Silicon Valley. In contrast, these constraints are seen as possibly fueling demand in emerging markets where power is available, such as Charlotte, N.C., Johannesburg and Mumbai, all places where CBRE discerns rising demand for hyperscale development.

“Reliable power is a top priority for many data center operators and technology advances will increase this need going forward,” said Gordon Dolven, director of Americas Data Center Research at CBRE. “New development is occurring across all regions despite limited power availability, yet large occupiers are finding it difficult to find enough data center capacity, giving impetus to emerging markets that have robust power supplies.”

The report confirms that large corporations are finding it increasingly difficult to find enough data center capacity, with factors such as low supply, construction delays and power challenges impacting all markets. As stated by the report's Executive Summary, "For example, Querétaro, Mexico, has only 1.2 MW available for lease."

CBRE says the worldwide shortage of available supply is leading to price increases for data center capacity. The report finds that Singapore has the highest rental rates at $300 to $450 per month for a 250- to 500-kilowatt (kW) requirement, while Chicago has the lowest at $115 to $125.

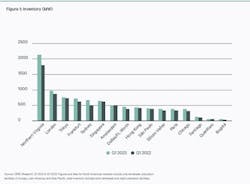

The report finds new development occurring across all four key global regions, despite limited power availability, with Northern Virginia reigning as the world's largest data center market with 2,132 megawatts (MW) of total inventory.

Vacancy rates declining

New development notwithstanding, the research finds vacancy rates declining in all four regions due to the strength of demand, as demand outstrips supply growth. For instance, CBRE data finds that Singapore, the world’s most power-constrained data center market, has less than 4 MW of available capacity and a record-low vacancy rate of less than 2%.

This trend is also notable in Santiago, Chile, where CBRE found vacancy dropped to 3% in Q1 2023 from 11.7% a year earlier. Similarly, in Chicago, the report discovers that vacancy fell to 6.7% in Q1 2023 from 8.2% a year earlier– the biggest decrease in any North American market -- even as inventory grew 21%.

“Strong demand for data centers is driving the increase in supply. Still, we’re seeing low vacancy rates across the globe, particularly in North America, where vacancy is the lowest in a decade,” explained Pat Lynch, executive managing director for CBRE’s Data Centers Solution.

Lynch added, “We anticipate constraints on capacity and development to ease in the next few years, though it won’t entirely go away as an issue for the industry. As a result, operators and occupiers are expanding into new markets, which presents exciting opportunities for next-tier metro areas.”

Meanwhile, CBRE finds that data center inventory continues to climb in many markets, where power availability and capacity limits have not yet slowed new development. For example, the report notes that inventory increased 32% in Sydney from Q1 2022 to Q1 2023, and increased 19.5% in the world's largest data center market, Northern Virginia.

AI and HPC drive demand, innovation

Notably, the report finds that the rapid growth of artificial intelligence has contributed to steady leasing activity -- despite higher interest rates and economic uncertainty -- and is expected to drive future data center demand, along with other modern technologies, such as streaming, gaming and self-driving cars.

As reckoned by CBRE, "This will spur innovations in data center design and technology as operators aim to deliver the capacity that meets the increased power density requirements of high-performance computing."

The research in the new report reinforces many trends that DCF has been tracking this year. It must be noted that, of the eight trends that DCF saw shaping the data center industry in 2023, "Supply and demand meets constraints and delays" came in at number one.

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.