AI Supercharges Hyperscale: Capacity, Geography, and Design Are Being Redrawn

Key Takeaways

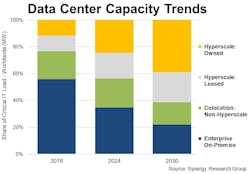

- Hyperscalers now control 44% of global capacity, projected to reach 61% by 2030, led by cloud and AI growth.

- On-premises and colocation centers grow slower, dropping from 56% to 34% market share in six years.

- The U.S. dominates hyperscale, with 14 of the top 20 global markets and 62% of capacity.

- Large hyperscale campuses are under construction in Texas, Virginia, Wisconsin, and Arizona, optimized for AI workloads.

- AI drives new design demands: higher rack densities, early substations, and large-scale land acquisitions.

- Private capital and infrastructure partnerships accelerate builds; power and environmental factors increasingly shape sites.

- Secondary U.S. markets like Columbus and Kansas City are rising as attractive hyperscale locations.

- The ecosystem adapts as colo providers, power developers, and suppliers align with hyperscale needs.

From Cloud to GenAI, Hyperscalers Cement Role as Backbone of Global Infrastructure

Data center capacity is undergoing a major shift toward hyperscale operators, which now control 44 percent of global capacity, according to Synergy Research Group. Non-hyperscale colocations account for another 22 percent of capacity and is expected to continue, but hyperscalers projected to hold 61 percent of the capacity by 2030.

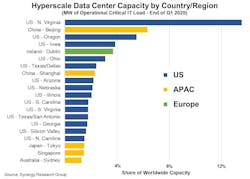

That swing also reflects the dominance of hyperscalers geographically. In a separate Synergy study revealing the world’s top 20 hyperscale data center locations, just 20 U.S. state or metro markets account for 62 percent of the world’s hyperscale capacity.

Northern Virginia and the Greater Beijing areas alone make up 20 percent of the total. They’re followed by the U.S. states of Oregon and Iowa, Dublin, the U.S. state of Ohio, Dallas, and then Shanghai. Of the top 20 markets, 14 are in the U.S., five in APAC region, and only one is in Europe.

This rapid shift is fueled by the explosive growth of cloud computing, artificial intelligence (AI), and especially generative AI (GenAI)—power-intensive technologies that demand the scale, efficiency, and specialized infrastructure only hyperscalers can deliver.

What’s Coming for Capacity

The capacity research shows on-premises data centers with 34 percent of the total capacity, a significant drop from the 56 percent capacity they accounted for just six years ago.

Synergy projects that by 2030, hyperscale operators such as Google Cloud, Amazon Web Services, and Microsoft Azure will claim 61 percent of all capacity, while on-premises share will drop to just 22 percent.

So, it appears on-premises data centers are both increasing and decreasing. That’s one way to put it, but it’s about perspective. Synergy’s capacity study indicates they’re growing as the volume of enterprise GPU servers increases. The shrinkage refers to share of the market: Hyperscalers are growing much faster than on-premises data centers, which is leading to a reduction in on-premises share of total data center capacity.

However, even though colocation and on-premises data centers will continue to lose share, they still will continue to grow. They just won’t be growing as fast as hyperscalers. So, it creates the illusion of shrinkage when it’s just slower growth.

In fact, after a sustained period of essentially no growth, on-premises data center capacity is receiving a boost thanks to GenAI applications and GPU infrastructure.

Forecasting Hyperscaler Growth

The prevalence of U.S. markets in the list of top 20 hyperscale data center locations is primarily influenced two factors:

- 60 percent of the world’s hyperscale operators are headquartered in the U.S., including the four biggest.

- U.S. accounts for almost half of all cloud market revenues in several key segments.

Looking ahead, the U.S. and China will continue to dominate the numbers, though several up-and-coming tier two markets will start to feature more prominently.

“A range of factors influence the choice of location for hyperscale infrastructure, including proximity to customers, availability and cost of real estate, availability and cost of power, networking infrastructure, ease of doing business, local financial incentives, political stability, and minimizing the impact of natural hazards,” said John Dinsdale, a Chief Analyst at Synergy Research Group.

Hyperscale in Action: U.S. Buildouts Reshape Regional Infrastructure

While Synergy Research’s data quantifies the concentration of capacity in hyperscale hands, the implications for U.S. infrastructure are unfolding in real time. A new generation of hyperscale campuses - larger, denser, and faster to market - is rapidly transforming the physical and economic landscape in top-tier and emerging regions alike.

This shift isn’t just about where capacity is located. It’s about how it’s being deployed, who’s building it, and what it’s designed to support. With generative AI workloads redefining performance and efficiency baselines, hyperscale providers are furthering an arms race for megawattage, water, and latency-optimized proximity to fiber and power nodes.

U.S. Mega-Campuses Underway: Strategic Context

-

Abilene, Texas — “Stargate” AI Megacampus

Backed by OpenAI, Oracle, SoftBank, and MGX, this flagship Stargate site is rising on 875 acres outside Abilene. Site plans now call for eight buildings totaling ~4 million square feet and ~1.2 GW of AI compute, with Oracle deploying $40B worth of Nvidia GPUs to support OpenAI workloads. Developed by Crusoe and financed through a $15B joint venture, the campus is powered by onsite gas turbines and grid upgrades, representing a new AI-first model for vertically integrated hyperscale infrastructure. -

Northern Virginia — Sustained Density at Record Scale

Northern Virginia (especially Loudoun and Prince William counties) remains the global epicenter of hyperscale data center development, with roughly 1.8 GW currently under construction and up to 15 GW of additional capacity announced or contracted. The region has exceeded 250 MW per year growth, doubling capacity in just a few years, and is projected to require 11–15 GW of new generation capacity by 2030 to keep pace with demand. The real bottleneck today is power delivery and interconnection, not land. Utilities and hyperscalers are adopting novel approaches, from distributed power procurement and direct transmission builds, including two new 500 kV lines in Eastern Loudoun to free up about 6 GW, to modular, batch-based interconnection systems, and flexible modular construction scaling. At the same time, public scrutiny continues to intensify, with community opposition rooted in noise, air emissions, and environmental impacts as the AI-powered boom escalates. -

Dallas–Fort Worth — Private Capital Enters the Chat

KKR and ECP’s joint $4B+ hyperscale development, anchored by CyrusOne and rumored to be preleased to a major AI player, exemplifies how private equity is accelerating next-generation data center growth. Located outside Dallas, the campus will deliver 144 MW of IT load in its first phase, expandable to 190 MW across more than 700,000 square feet. A long-term PPA with Calpine’s Thad Hill Energy Center ensures dedicated natural gas generation. With modular buildout, tenant commitment, and deep infrastructure capital behind it, the project reflects a new private equity-backed model for AI infrastructure at scale. -

Mount Pleasant, Wisconsin — Microsoft’s $3.3B Midwest Pivot

Microsoft’s now $3.3 billion commitment at the former Foxconn site signals both a geo-diversification strategy and a reclamation of underutilized infrastructure. The campus, expected to support AI-specific workloads, is a case study in how hyperscalers are repurposing failed industrial megaprojects to meet new digital infrastructure goals. -

Mesa, Arizona — Desert Optimization

Meta, Google, and NTT are investing heavily in Mesa and surrounding Maricopa County, drawn by renewable energy optionality, tax incentives, and access to transcontinental fiber routes. Meta’s $800 million campus, Google’s $600 million facility, and NTT’s 173-acre site with plans for up to 360 MW all reflect the region’s growing hyperscale momentum. In response to increasing scrutiny over water use, these operators are advancing dry and air-based cooling, recycled water strategies, and LEED-certified high-efficiency designs. Mesa is also becoming a proving ground for build-to-suit hyperscale campuses in power- and water-constrained regions.

In this episode of the datacenterHawk podcast, hosts Mike Netzer, VP of Sales and Marketing, and David Liggitt, President and Founder at datacenterHawk, discuss how the hyperscale transformation is a powerful testament to the data center industry's rapid expansion and adaptation.

AI: The Great Reshaper of Hyperscale Design

The key accelerant across all these builds? Generative AI. While traditional hyperscale builds were optimized for cost per watt and maximum uptime, new AI workloads demand higher rack densities, liquid cooling compatibility, and flexible compute orchestration. The result is a new playbook:

- Rack densities routinely exceeding 30–50 kW.

- Onsite substations built early in phase one.

- Multi-gigawatt land banking in less saturated power zones.

- Full-stack integration from chip to cooling to grid interconnect.

“The AI era doesn’t just need more data centers; it needs different data centers,” said one hyperscale development executive at a recent industry conference. “We’re no longer just scaling compute. We’re scaling heat, power, talent, and supply chains, all at once.”

Strategic Signals for the Ecosystem

These megaprojects provide critical signals for the wider data center ecosystem:

- Colo providers are increasingly aligning with hyperscalers through campus-adjacent footprints, or serving as short-term capacity offload while long-term builds are underway.

- Power developers (including natural gas and SMR players) are embedding earlier in project planning, often through joint ventures.

- Transmission infrastructure and substation delivery timelines are now pacing factors in site selection, often more than fiber or land cost.

- Second-tier metros (such as Columbus, Kansas City, and Omaha) are seeing a surge of site control activity as hyperscalers seek lower-cost power and more favorable entitlements.

Looking Ahead: Hyperscale’s Expanding Footprint

As hyperscale operators accelerate their development timelines to meet the demands of AI and cloud services, the geography, architecture, and economics of the data center industry are undergoing a profound transformation. The traditional boundaries of top-tier markets are expanding, with second-tier metros and emerging energy corridors increasingly factoring into long-term capacity planning.

While the pace and scale of hyperscale growth may dominate headlines, the underlying dynamics remain nuanced. On-premises and colocation facilities continue to evolve in parallel - driven by specialized workloads, edge computing, and regulatory requirements -underscoring the diversity of demand across the broader infrastructure landscape.

In a market where capacity is no longer just about square footage but about power availability, deployment velocity, and network performance, hyperscalers are redefining what competitive advantage looks like. That shift is not only reshaping the global data center map, but also setting a new baseline for the industry’s next phase of growth.

At Data Center Frontier, we talk the industry talk and walk the industry walk. In that spirit, DCF Staff members may occasionally use AI tools to assist with content. Elements of this article were created with help from OpenAI's GPT4.

Keep pace with the fast-moving world of data centers and cloud computing by connecting with Data Center Frontier on LinkedIn, following us on X/Twitter and Facebook, as well as on BlueSky, and signing up for our weekly newsletters using the form below.

About the Author

Theresa Houck

Senior Editor

Theresa Houck, Senior Editor, is an award-winning B2B journalist with more than 35 years of experience. She writes about strategy, policy, and economic trends for EndeavorB2B on topics including data centers, cybersecurity, IT, OT, AI, manufacturing, industrial automation, energy, and more. With a master’s degree in communications from the University of Illinois Springfield, she previously served as Executive Editor for four magazines about sheet metal forming and fabricating at the Fabricators & Manufacturers Association, where she also oversaw circulation, marketing, and book publishing. Most recently, she was Executive Editor for the award-winning The Journal From Rockwell Automation publication on industrial automation where she also hosted and produced podcasts, videos and webinars; produced eHandbooks and newsletters; executed social media strategy; and more.

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.