Data Bytes: Hyperscale Buying Boosts Market for ODM, Open Compute Gear

Data Bytes is a weekly roundup of research and analysis for the data center and cloud computing sector. Want to get it in your Inbox every Monday? Sign up for our DCF news updates.

The pandemic has boosted sales of hyperscale hardware, especially custom servers and storage from ODM (original design manufacturing) vendors and Open Compute specialist Inspur, according to new data from Synergy Research Group and IDC. As a result, sales of ODM servers now surpass the sales for the leading OEMS (original equipment manufacturers) Dell and HPE.

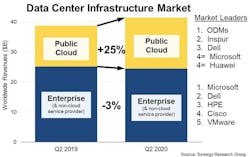

The latest Synergy update found that worldwide spend on data center hardware and software in the second quarter of 2020 increased by 7% from the 2019, thanks to a 25% jump in spending on public cloud infrastructure, which pushed it to an all-time high.

Original design manufacturers (ODMs) accounted for the largest portion of sales in the public cloud market, with Inspur now the leading individual vendor, followed by Dell, Microsoft and Huawei. ODM vendors have been boosted by the trend for hyperscale providers to design their own custom infrastructure and work with third-party manufacturers like Quanta. Adoption of these “white box” servers have been driven by the growth of Amazon Web Services and the Open Compute Project, an open hardware movement created by Facebook but now also including huge purchasers such as Microsoft, Google, Alibaba and Tencent.

“In the middle of a global pandemic, spending on data center infrastructure was almost at an all-time high – second only to the fourth quarter of 2019,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “That speaks volumes about the continued robust growth in both enterprise and consumer cloud services. There was also a geographic story behind the growth. The US market grew at a good pace in the quarter, but among the larger markets it was China that was the standout performer, jumping almost 35% from the second quarter of last year.”

Total data center infrastructure equipment revenues, including both cloud and non-cloud, hardware and software, were $41.4 billion in Q2, with public cloud infrastructure accounting for 41% of the total.

While cloud providers continued to invest heavily in their data centers, enterprise spending slipped 3% from last year. The Q2 market leader in enterprise infrastructure was Microsoft, followed by Dell, HPE, Cisco and VMware.

Total data center infrastructure equipment revenues, including both cloud and non-cloud, hardware and software, were $41.4 billion in Q2

Server Sales Up 19 Percent

Synergy’s findings align with the latest data from International Data Corporation (IDC) Worldwide Quarterly Server Tracker, which reported that vendor revenue in the worldwide server market grew 19.8% year over year to $24.0 billion during the second quarter of 2020 (2Q20). Worldwide server shipments grew 18.4% year over year to nearly 3.2 million units in 2Q20.

IDC also saw gains for the custom gear builders. The ODM Direct group of vendors accounted for 28.8% of total server revenue at $6.9 billion with year-over-year growth of 63.4% and delivered 34.4% of all units shipped during the quarter, while Inspur had 10.5% share and impressive 77% year-over-year growth. That gave ODM or Open Compute specialists just shy of 40 percent market share in terms of revenue, compared to about 29 percent for the combination of Dell and HPE (which remain tied as the leading individual vendors).

In terms of server class, volume server (which includes cloud computing servers) revenue was up 22.1% to $18.7 billion, while midrange server revenue declined 0.4% to about $3.3 billion and high-end systems grew by 44.1% to $1.9 billion.

“Global demand for enterprise servers was strong during the second quarter of 2020,” said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC. “We certainly see areas of reduced spending, but this was offset by investments made by large cloud builders and enterprises targeting solutions that support shifting infrastructure needs caused by the global pandemic. Investments in Asia/Pacific were also particularly strong, growing 31% year over year.”

Significantly, IDC sees more growth ahead for Open Compute server and storage infrastructure, which is forecast to see a compound annual growth rate (CAGR) of 16.6% over the 2020-2024 forecast period.

“By opening and sharing the innovations and designs within the community, IDC believes that OCP will be one of the most important indicators of datacenter infrastructure innovation and development, especially among hyperscalers and cloud service providers,” said Sebastian Lagana, research manager, Infrastructure Systems, Platforms and Technologies.

About the Author