How Geothermal Energy Is Gaining Ground in AI Data Center Power Strategies

Key Highlights

- Fervo Energy's $462 million Series E funding marks a key milestone, supporting the development of the 500 MW Cape Station project, which aims to deliver reliable, carbon-free power to the grid by 2028.

- Project InnerSpace's analysis indicates geothermal can supply electricity and cooling at costs comparable to natural gas by 2035, with potential savings of up to $3.2 billion over 30 years for data centers using thermal energy for cooling.

- Global initiatives, including Europe's GeoMap platform and policies in Germany and Latin America, are expanding geothermal resource mapping and deployment, making it a more accessible and strategic option for digital infrastructure.

- Geothermal's integration into energy planning frameworks and its alignment with AI-driven demand underscore its emerging role as a location-specific, firm power resource for data centers.

- Despite challenges like high capital costs and slower deployment, geothermal is increasingly viewed as a credible, long-term energy solution, moving from niche to core in the data center energy landscape.

Earlier this year, we renewed our examination of geothermal energy as a potential behind-the-meter solution to the data center industry’s accelerating power constraints, drawing on new analysis from Rhodium Group and early hyperscaler partnerships with developers like Google partner Fervo Energy and Meta's investment in Sage Geosystems. At the time, the case was compelling but still largely anticipatory—rooted in modeling, pilot projects, and policy-enabled possibility.

Since then, the conversation has shifted.

What has emerged over the course of 2025 is a clearer signal that geothermal is beginning to move from conceptual alignment with data center needs toward early execution at meaningful scale. The technology has not suddenly matured, nor have its constraints disappeared. But capital formation, cost modeling, and global market engagement have started to line up in ways that make geothermal harder to dismiss as merely theoretical.

Capital Commits Where Execution Is Underway

The most concrete recent marker of geothermal’s changing role arrived on December 10, when Fervo Energy announced the close of a $462 million oversubscribed Series E financing round to accelerate development of its Cape Station project in Beaver County, Utah. Led by B Capital, the round drew participation from a broad mix of energy, infrastructure, and technology-aligned investors, underscoring growing confidence that geothermal can be scaled into a reliable source of clean, firm power at grid-relevant levels.

The new capital will support continued construction of Cape Station and early development across Fervo’s expanding project pipeline. Cape Station is expected to begin delivering 100 MW of carbon-free power to the grid in 2026, with an additional 400 MW coming online by 2028, bringing the project to a total capacity of 500 MW. When complete, it is positioned to become the largest next-generation geothermal development in the world.

Equally notable is the project’s execution profile. Fervo reports that drilling times at Cape Station are declining and operational efficiencies are improving with each successive well—evidence that the application of advanced drilling techniques and subsurface analytics is beginning to translate into repeatability, not just technical proof points. That learning-curve dynamic is central to geothermal’s long-term relevance for data centers, where predictability and schedule confidence increasingly matter as much as theoretical resource potential.

In announcing the round, Fervo framed Cape Station not as a standalone project, but as a foundational asset in what it describes as a “clean, firm power fleet” designed to meet surging demand from AI-driven load growth and broader electrification. That framing aligns closely with how data center operators are now evaluating energy options: less as isolated PPAs, and more as long-lived infrastructure platforms capable of supporting multi-decade growth.

For the data center industry, the significance of Fervo’s Series E is not that geothermal has suddenly become ubiquitous or universally deployable. It is that capital is now being committed at a scale and toward projects with timelines that intersect meaningfully with the next wave of hyperscale and AI campus development. In a power market defined by scarcity, congestion, and long lead times, that alone marks an important shift.

Modeling the Path From Resource to Reality

If Fervo’s December financing underscored growing confidence on the capital side, new analysis from Project InnerSpace sharpened the economic and operational case for geothermal’s relevance to data center infrastructure.

In July, Project InnerSpace released an in-depth technoeconomic study examining the feasibility of a 1-gigawatt geothermal project purpose-built to power and cool a hyperscale data center. Titled From Core to Code: Powering the AI Revolution with Geothermal Energy, the analysis moved beyond high-level resource estimates to model real-world costs, timelines, and system interactions under current U.S. policy and market conditions.

The study found that a first-of-a-kind geothermal project located in a region with strong subsurface resources could deliver electricity and thermal energy to data centers at approximately $88 per MWh using existing federal tax credits. With consistent investment, supply-chain development, modular plant design, and learning-curve effects, Project InnerSpace estimates those costs could decline to the $50–$60 per MWh range by 2035, placing geothermal on a cost trajectory comparable to natural gas and below that of nuclear, while maintaining a clean, firm operating profile.

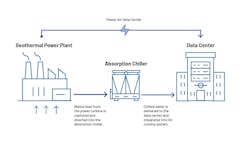

What distinguishes the analysis is its treatment of geothermal as more than a power source. The study explicitly models geothermal’s ability to supply both electricity and cooling, estimating that data center operators could save up to $3.2 billion over 30 years by using excess geothermal thermal energy for direct cooling. In high-density AI facilities, where cooling can account for 30–40% of total energy consumption, that dual-use capability materially alters the economics of total facility design.

The report also emphasized scale. Project InnerSpace estimates that the United States has roughly 3,400 GW of geothermal potential accessible with today’s drilling technologies: far exceeding projected data center demand. Importantly, the study highlighted geothermal’s workforce compatibility, noting that approximately 80% of oil and gas skill sets are transferable to geothermal development, reducing one of the less visible but persistent barriers to energy infrastructure build-out.

Policy support remains central to the modeled outcomes. The analysis found that an $11 billion investment tax credit applied to a first-of-a-kind 1 GW project could drive a 61% reduction in delivered energy costs over time, accelerating the path to commercial competitiveness. Streamlined permitting and early-project de-risking were identified as key levers for unlocking private capital at scale.

Project InnerSpace also pointed toward emerging planning tools that may help bridge the gap between energy resources and digital infrastructure siting. Its GeoMap subsurface database now includes a data center module designed to help operators identify locations where geothermal resources, cooling potential, and digital infrastructure needs align—reflecting a growing recognition that power availability must be considered earlier and more holistically in site selection.

For data center operators, the Project InnerSpace analysis does not suggest geothermal is universally cheaper or faster than incumbent power options today. Rather, it provides a more grounded roadmap for how geothermal could evolve into a competitive, infrastructure-grade solution over the next decade, one that aligns with AI workloads’ need for clean, firm, and thermally efficient energy systems.

Taken together with recent capital commitments and early project execution, the modeling reinforces a broader shift underway: geothermal is no longer being evaluated solely on theoretical resource abundance, but on its ability to integrate into the full technical, economic, and operational stack of modern data center development.

Policy as a Quiet Enabler

Another throughline that has become clearer this year is the role of policy, not as a headline driver, but as a background stabilizer.

Federal investment tax credits, DOE-backed research into enhanced geothermal systems, and support for drilling cost reduction and subsurface mapping are collectively lowering risk profiles for early projects. At the same time, geothermal’s strong overlap with oil and gas skill sets (often cited at roughly 80 percent) positions it as an industrial transition rather than a workforce disruption.

For policymakers grappling with how to support AI-era infrastructure growth without exacerbating grid fragility, geothermal increasingly checks multiple boxes at once.

A Broader Geographic Lens

While much of the early momentum around geothermal for data centers has been U.S.-centric, developments across multiple regions in the past year show that geothermal’s relevance to digital infrastructure is becoming a global conversation, not just a stateside footnote.

In Indonesia, state-owned Pertamina Geothermal Energy has begun working with industry groups and academic institutions to develop a roadmap for geothermal-powered “green data centers,” driven by rising digital demand and long-term energy availability concerns. Similar dynamics are emerging in Taiwan and other geothermally rich regions where grid constraints, land scarcity, and sustainability mandates converge.

In Europe, momentum is building on both the policy and resource-mapping fronts. More than 20 industry and energy organizations have recently called on the European Commission to ensure its forthcoming EU Geothermal Action Plan fully addresses advanced geothermal technologies—including high-temperature systems capable of producing around-the-clock clean power and industrial heat at competitive costs. The plan, expected in early 2026, is seen as a key enabler to unlock broader deployment of firm geothermal energy across the bloc.

Complementing that policy push, Project InnerSpace recently launched GeoMap Europe, a continent-wide geothermal mapping and prospecting platform that aggregates decades of subsurface data to reveal Europe’s vast—but underexploited—geothermal potential for heat, power, and cooling applications. This kind of high-resolution mapping is critical for aligning energy developers with data center developers on siting decisions that balance resource quality, grid access, and economic viability.

National actions are also under way. For example, Germany’s federal parliament recently passed legislation aimed at accelerating the expansion of geothermal energy plants, heat pumps, and associated infrastructure, signaling a willingness to streamline the regulatory environment for geothermal development even as broader energy policy evolves.

Beyond Europe, geothermal deployment continues to advance in other regions. In Latin America, binary geothermal power plants are being inaugurated, and drilling interest is growing across the Caribbean and Central America, reflecting broader global recognition of geothermal’s role in a diversified clean energy mix.

Meanwhile, East Africa’s expanding geothermal fleet—such as the under-construction Menengai II project in Kenya—illustrates that geothermal resource development continues apace in places where stable, indigenous power is urgently needed.

These global signals matter to data center investors and operators for two reasons. First, they expand the set of locations where geothermal could meaningfully contribute to power and cooling strategies beyond traditional hydrothermal basins. Second, they demonstrate that geothermal is increasingly being integrated into national and regional energy planning frameworks, elevating its profile as a resource not just for utilities, but for industrial and digital infrastructure customers alike.

In short, geothermal’s footprint is broadening, from targeted U.S. developers racing to meet AI-era demand to policy architects and mapping initiatives in Europe, and emerging project pipelines in Africa, Latin America, and Asia. Each of these threads reinforces the core theme of this year’s coverage: geothermal is no longer a peripheral option: it is entering the infrastructure conversation on multiple continents, with implications for how and where data centers will secure clean, firm power going forward.

The significance of these developments is not that geothermal-powered data centers will suddenly proliferate globally, but that data centers are increasingly being viewed as anchor customers capable of underwriting new geothermal development. That logic mirrors what has already occurred with wind and solar PPAs, only with a firm, always-on resource.

What Has (and Hasn’t) Changed

Geothermal is not a universal solution. It remains capital-intensive, geology-dependent, and slower to deploy than gas-fired generation. Not every data center market will be a viable candidate, and not every operator will have the risk tolerance or timeline flexibility required.

But what has changed over the course of this year is the industry’s posture toward geothermal.

It is no longer discussed solely as a niche sustainability option or a distant research pathway. It is being financed, modeled, and planned in the same strategic conversations that now include natural gas microgrids, small modular nuclear, and long-duration storage.

For data center operators navigating the next phase of AI-driven growth, geothermal’s role is becoming clearer: not as a dominant backbone of the power system, but as a credible, location-specific tool in a tightening energy landscape.

In that sense, geothermal’s story in 2025 is not about sudden disruption. It is about steady reentry; moving quietly, but deliberately, from the margins toward the core of the data center energy conversation.

At Data Center Frontier, we talk the industry talk and walk the industry walk. In that spirit, DCF Staff members may occasionally use AI tools to assist with content. Elements of this article were created with help from OpenAI's GPT5.

Keep pace with the fast-moving world of data centers and cloud computing by connecting with Data Center Frontier on LinkedIn, following us on X/Twitter and Facebook, as well as on BlueSky, and signing up for our weekly newsletters using the form below.

About the Author

Matt Vincent

A B2B technology journalist and editor with more than two decades of experience, Matt Vincent is Editor in Chief of Data Center Frontier.