Data Bytes: AI Still an Enterprise Priority, Even as Growth Slows for COVID-19

Data Bytes is a weekly roundup of research and analysis for the data center and cloud computing sector. Want to get it in your Inbox every Monday? Sign up for our DCF news updates.

Investment in artificial intelligence (AI) has remained strong during the COVID-19 pandemic, with the pace of growth moderating only slightly during 2020 and picking up in 2021 and beyond, according to new research from International Data Corporation (IDC).

Global revenues for AI software, hardware, and services are expected to total $156.5 billion in 2020, an increase of 12.3% over 2019. IDC ‘s Worldwide Artificial Intelligence Tracker projects worldwide revenues surpassing $300 billion in 2024 with a five-year compound annual growth rate (CAGR) of 17.1%.

“The pandemic has interrupted the momentum of AI services market growth in nearly all regions,” said Jennifer Hamel, research manager, Analytics and Intelligent Automation Services. “However, enterprise demand for AI capabilities to support business resiliency and augment human productivity will sustain double-digit expansion in 2020 even as other discretionary projects experience delays.”

IDC expects AI hardware (server and storage combined) revenues to reach $13.4 billion in 2020, representing 10.3% year-over-year growth, which is a significant moderation from the prior year when it grew 33.4%. Within the hardware market, AI Storage is forecast to grow 11.4% this year, slightly ahead of AI Server, which is expected to grow 10.1%. However, from a size perspective, AI Server is responsible for more than 80% of total AI hardware revenues.

“The AI server market is expected to return to its previous growth trajectory in 2021, but with the US not having the pandemic under control, 2021 growth in the US will be lower than in China and Western Europe,” said Peter Rutten, research director in IDC’s Enterprise Infrastructure Practice.

The overall hardware market is forecast to have a strong recovery with 35.5% year-on-year growth next year, led by AI Storage, which is expected to grow 43.1% year over year.

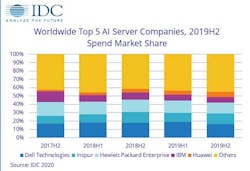

In terms of vendor share, the top 3 companies in AI Server are Dell, Hewlett Packard Enterprise, and Inspur. They are the only 3 competitors with double-digit market share in that market space. In the AI Storage market, Dell Technologies, NetApp, and Hewlett Packard Enterprise hold the top 3 positions.

“While the overall market has seen a slowdown due to the COVID-19 pandemic, investments for AI and analytics infrastructure will continue, and perhaps increase, in specific industries such as life sciences, healthcare and Media & Entertainment,” said Amita Potnis, research director in IDC’s Enterprise Infrastructure Practice. “Storage will see stronger growth than servers owing to new data generation along with existing datasets that will be curated to support AI models with increased adoption of high-performance parallel file systems and all-flash object stores.”

Software is the largest AI technology group delivering roughly 80% of all AI revenue. Most of the software revenue comes from AI Applications ($120.4 billion in 2020) with AI Software Platforms ($4.3 billion) delivering the remainder. Customer relationship management (CRM) AI Applications and enterprise risk management (ERM) AI Applications are the two largest segments with 20% and 17% share of the AI Applications market. Other key segments include AI for Content Workflow and Management Applications, Production Applications, and Collaborative Applications. While software will remain the largest category throughout the forecast, it will also see the slowest growth with a five-year CAGR of 16.7%.

“The role of AI Applications in enterprises is rapidly evolving,” said Ritu Jyoti, program vice president, Artificial Intelligence Research at IDC. “It is transforming how your customers buy, your suppliers deliver, and your competitors compete. AI applications continue to be at the forefront of digital transformation (DX) initiatives, driving both innovation and improvement to business operations.”

KPMG: Enterprises Pause Emerging Technologies Purchases

A KPMG International research report last week on enterprise IT spending reported a similar short-term impact in COVID-19 deferrals. In the immediate wake of COVID-19, Global 2000 companies moved to slash funding for emerging technologies, such as automation, artificial intelligence (AI), blockchain, and 5G, according to KPMG. However, many executives expect spending on these emerging technologies will likely increase in the next 12 months,” as enterprises recognize COVID-19 creates a burning platform to accelerate digital transformation and stimulate long-term growth.”

The new report, a collaboration between KPMG International and HFS Research Enterprise Reboot, surveyed 900 technology executives. Fifty-seven percent of respondents say COVID-19 has significantly changed their organization’s strategic priorities. The immediate focus is now on survival, which has become the number one objective for most emerging technology investments.

“This crisis isn’t affecting all industries equally, but for many of the industries facing crisis, managing the transition to a digital business model is imperative,” said Cliff Justice, Global lead for Intelligent Automation and U.S. lead for Digital Capabilities, KPMG. “However, doing so is made more complicated in a time where investments are critical, but cash must be preserved.”

Specifically, 59 percent of executives surveyed say that COVID-19 has created an impetus to accelerate their digital transformation initiatives, yet approximately four in 10 say they will halt investment in emerging technology altogether as a result of COVID-19. Executives have shifted their focus to must-have technologies, and 56 percent of those surveyed say cloud migration has become an absolute necessity due to COVID-19.

However, investments in a number of emerging technologies will likely increase over the next year, such as 5G (44 percent of respondents expect spending to increase compared to 26 percent who expect spending to decrease); process automation (43 percent expect an increase compared to 25 percent who expect a decrease); AI (39 percent versus 31 percent); hybrid cloud and/or multi-cloud (38 percent versus 28 percent); blockchain (34 percent versus 30 percent); edge computing (34 percent versus 33 percent) – with the exception of smart analytics (32 percent versus 35 percent).

About the Author